Are Small Businesses on the Brink of Going Bust?

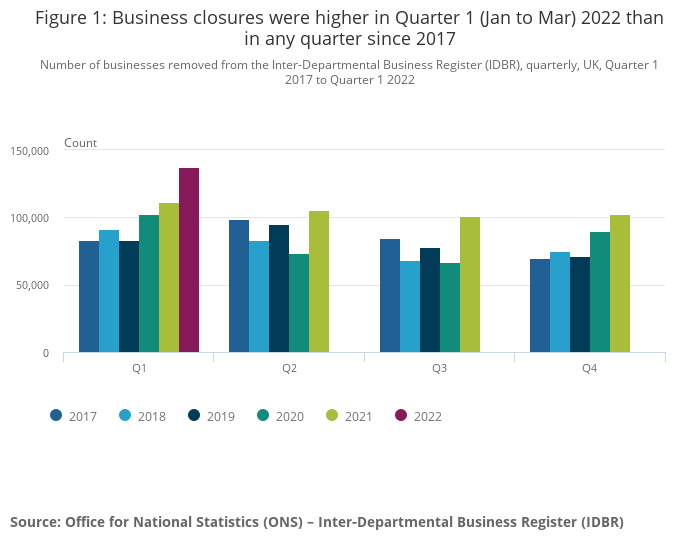

In a worrying sign of how small businesses are struggling, according to a report by PayPal in June 2022, a quarter of all small businesses are so worried about their financial health that they are turning a blind eye to potential problems they might have. Worse, 12% of business owners do not expect to be in business within one year, with a further 15% unsure about their future. Indeed, the latest ONS data about business closures shows that over 137k businesses closed in Q1 2022, up 23% from Q1 2021.

It is also the fourth quarter in a row where closures exceed creations. In part, though, this may be explained by the dramatic rise in the launch of new businesses in the last two years. In 2021, 810,316 new companies were launched, an increase of 21.8% compared to 2019. It was the highest number of launches on record.

These worries, stemming from various reasons, include fears of rising inflation - factory input prices have increased by 18.6% over the last year, a record rise. Other worries include supply chain issues and difficulties finding staff. All these are causing 62% of business owners to have sleepless nights and 33% to feel alone and isolated.

According to the PayPal report, one-way business owners are trying to keep their businesses going is by regularly working at weekends (44%), and more than a third (36%) will go at least six months before taking a holiday or time off, if at all.

ONS statistics bear out these worries. They suggest that 40% of some 2m businesses had less than three months' worth of cash, with the consequent potential risks to these businesses and employees. Of these 2m, the Federation of Small Businesses estimated that about 10%, or some 200k, were in serious trouble. Another 300k have potentially only a few weeks of cash left before they go bust.

Financial woes and stress can hurt health and wellness. In tough times, staying on top of their financial wellness is a vital tool for small business owners. It needs to be a priority to minimise the personal impact of running a business, which can be an isolating and challenging experience for entrepreneurs.

Ben Ramsden, Head of SMEs, PayPal UK

Not all SMEs are gloomy

The future is brighter for some. Research by Enterprise Nation and Starling Bank found that 43% of small businesses are back at pre-pandemic levels. Many have learned lessons about financial management and plan to grow through expansion. With the right support, small businesses can develop resilience to face economic turbulence.